owner draw quickbooks s-corp

Corporations should be using a liability account and not equity. Closing Drawing Account This is accomplished by making a credit entry in the drawing account for whatever the debit balance is and making a debit entry for that amount in the owners capital account.

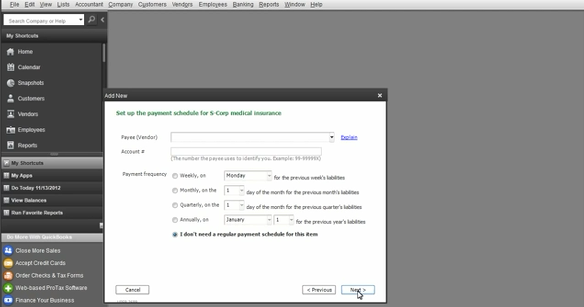

Apply S Corp Medical At Year End For Corporate Officers Insightfulaccountant Com

Are usually either for estimated taxes due to a specific event or from business growth.

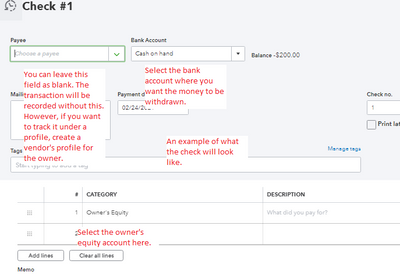

. Set up and pay an owners draw. As a business owner at least a part of your business bank account belongs to you. Click Save and Close.

An owners draw account is an equity account used by QuickBooks Online to track withdrawals of the companys assets to pay an owner. Friday April 1 2022. According to IRS internal system those corporations that are elected to share the profit losses income deduction and credits to there shareholders for the purpose of paying federal taxes are called s corporations.

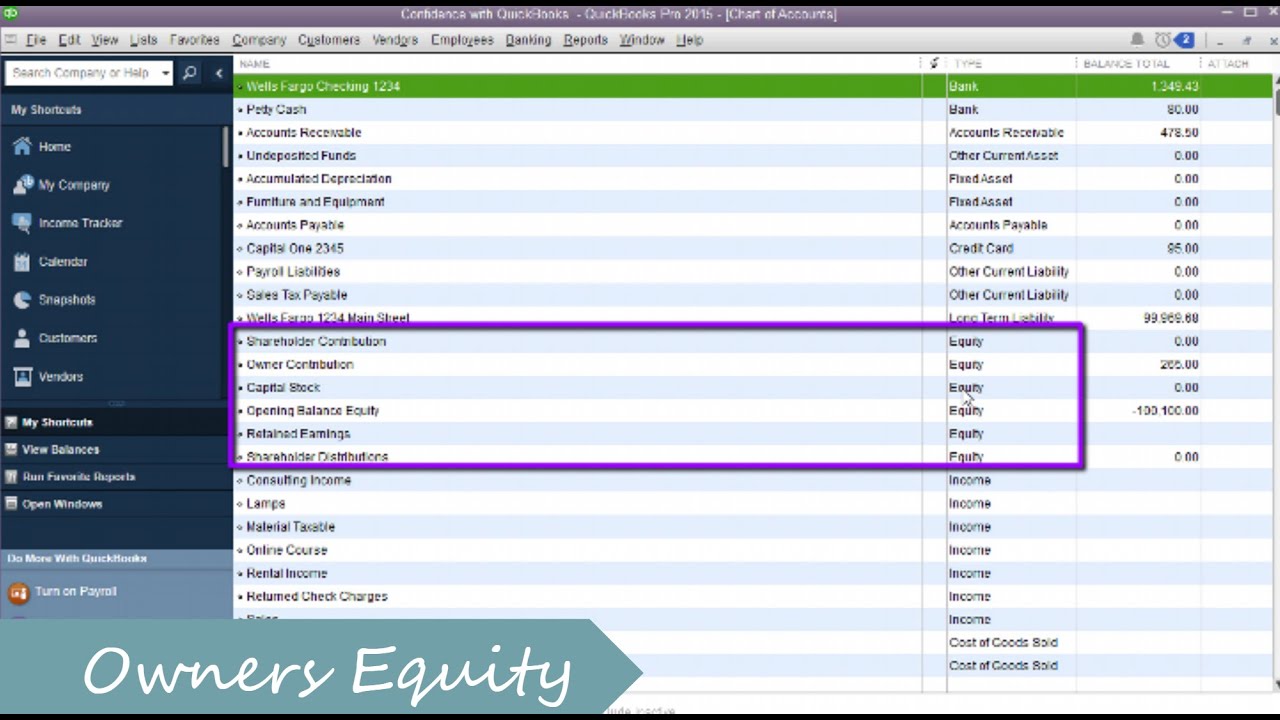

To record owners draws you need to go to your Owners Equity Account on your balance sheet. Choose Lists Chart of Accounts or press CTRL A on your keyboard. If youre a sole proprietor you must be paid with an owners draw instead of employee paycheck.

Select the Gear icon at the top and then select Chart of Accounts. A reference for the steps can be found here. If A draws a 100000 salary Ss taxable income will be reduced to zero.

Owners draws or withdrawals is never an expense. An owners draw refers to an owner taking funds out of the business for personal use. Due tofrom owner long term liability correctly.

When the owner of a business takes money out of the business bank account to pay personal bills or for any other personal expenditures the money is treated as a draw on the owners equity in the business. How do you handle owner draws in QuickBooks. Once done click Save and close.

This tutorial will show you how to record an owners equity draw in QuickBooks OnlineIf you have any questions please feel free to ask. A owns 100 of the stock of S Corp an S corporation. Only a sole proprietorship a partnership a disregarded entity LLC and a partnership LLC can have owner draws.

As an S-Corporation suddenly you have a choice to make every time money leaves the companys hands and gets into yours. Recording draws in quickbooks requires setting up owner draw accounts and posting monies taken out of the business bank account for personal reasons to. Click Account New at the bottom left.

The funds are transferred from the business account to the owners personal bank account. Owners draws can give S corps and C corps extra tax savings. An owners draw is an amount of money an owner takes out of a business usually by writing a check.

A members draw also known as an owners draw or a partners draw is a QuickBooks account that records the amount taken out of a company by one of its owners along with the amount of the owners investment and the balance of the owners equity. If youre curious about the notion of tracking the withdrawal of company assets to pay an owner in QuickBooks Online keep. You can adjust it based on your cash flow personal needs or how your company is performing.

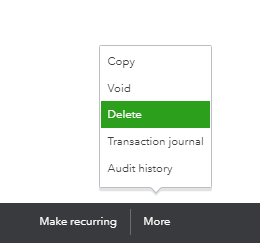

S generates 100000 of taxable income in 2011 before considering As compensation. At the end of the year or period subtract your Owners Draw Account balance from your Owners Equity Account total. Any money an owner draws during the year must be recorded in an Owners Draw Account under your Owners Equity account.

An owner of a C corporation may not. Enter the account name and description Owners Draw is recommended. A draw lowers the owners equity in the business.

A is also Ss president and only employee. An owners draw gives you more flexibility than a salary because you can pay yourself practically whenever youd like. How do you close out owners draw to Retained Earnings.

Owners draw in quickbooks. Also an accountant will be able to shed some more ideas about recording this. I know that using a Liability account isnt technically correct but the basic accounting equation can be sorted out easy enough Assets - Liabilities Owners Equity.

Recording draws in Quickbooks requires setting up owner draw accounts and posting monies taken out of the business bank account for personal reasons to. This article describes how to Setup and Pay Owners Draw in QuickBooks Online Desktop. Pros of an owners draw Owners draws are flexible.

An owners draw is a separate equity account thats used to pay the owner of a business. Is it a draw or a salary. Add other details of the check such as reference number memo etc.

An owner of a sole proprietorship partnership LLC or S corporation may take an owners draw. To create an Equity account. Many small business owners compensate themselves using a draw rather than paying themselves a salary.

Create a business Other Liability account. If you own a business you should pay yourself through the owners draw account. For more details on how to record an owners draw in Quickbooks keep reading.

Under Category select the Owners Equity account then enter the amount. Patty could withdraw profits generated by her business or take out funds that she previously contributed to her company. An owners draw account is an equity account used by QuickBooks Online to track withdrawals of the companys assets to pay an owner.

Since an s corp is structured as a corporation there is no owners draw only shareholder distributions. The capital account is similar to the retained earnings account in a corporation. If youre a sole proprietor you must be paid with an owners draw instead of employee paycheck.

Being a business owner there is no need to confuse between corp and s corporations. Make sure you use owners contributionsdraws equity vs. An owners draw account is a type of equity account in which QuickBooks Desktop tracks withdrawals of assets from the company to pay an owner.

Home draw employed quickbooks wallpaper owners draw in quickbooks self employed. Example 1. The information contained in this article is not tax or legal advice and is.

It is not necessary that s corp is a business enterprise. Are infrequent in nature. Youre allowed to withdraw from your share of the businesss value.

I named it Shareholder Draws to be consistent with what I had in QBs. To open an owners draw account follow these steps.

Apply S Corp Medical At Year End For Corporate Officers Insightfulaccountant Com

How To Pay Expenses W Owner Funds In Quickbooks Online Youtube

Taxation In An S Corporation Distributions Vs Owner S Compensation Youtube

Best Online Invoice Billing Software Invoicing Software Create Invoice Online Invoicing

Solved S Corp Officer Compensation How To Enter Owner Eq

6 Essential Words To Understanding Your Business Finances Small Business Bookkeeping Small Business Finance Business Finance

Solved Owner Has Been Incorrectly Taking Owners Draw Inst

Solved S Corp Officer Compensation How To Enter Owner Eq

We Switched From Sole Proprietor To S Corp Spoke

Solved S Corp Officer Compensation How To Enter Owner Eq

Question Can Llc Filing As S Corp Still Have Owner Draw Seniorcare2share

Icon Blank Timecard Template Card Templates Free Free Printable Card Templates Card Templates

Cost Analysis Template Analysis Cost Accounting Spreadsheet Template Business

Apply S Corp Medical At Year End For Corporate Officers Insightfulaccountant Com

Paystub Samples Professional Looking Templates Free Preview Payroll Template Paycheck Payroll Checks

Benefits Of Owning An S Corp Taking Distributions

How To Setup And Use Owners Equity In Quickbooks Pro Youtube

Quickbooks Chart Of Accounts For Contractors Small Corporation S Corp Desktop Bundle Fast Easy Accounting Store